Hot trends in healthcare

Continuing Packaging Today’s promise to provide insight from our partners at GlobalData, this supplement focuses on healthcare and over the counter pharmaceuticals, with an overview of the key trends and developments in 2017. Matthew Rogerson finds out more.

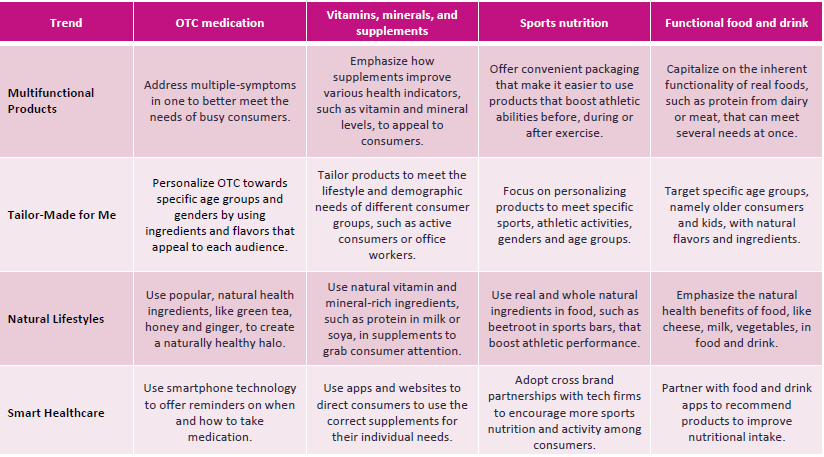

GlobalData has identified 4 key trends in healthcare and OTC based on their Q3 2016 survey of 26,800 consumers in 36 countries.

Key inhibitors

The market is experiencing noticeable inhibitors to growth, such as high prices, inconvenience, ineffective and unnatural perceptions. Many consumers are price-conscious because of the lingering effects of the recent global economic downturn in 2008. As a result, they are not willing to spend more on products personalised to their needs. In addition, increasingly busy lifestyles due to work and active social lives, mean consumers lack time and patience for products which are less convenient or more complex, such as those which are smart or personalised. This will limit the market’s potential growth as consumers are increasingly driven by time constraints to meet their health needs on daily basis. Finally, consumers are sceptical of “unnatural” products as they perceive them to be low quality; this will specifically inhibit the appeal of multifunctional products that don’t contain some level of “natural” ingredients.

Key drivers

Global consumers are becoming more health conscious as a reaction to rising obesity levels and lifestyle-related illnesses, such as diabetes, in the modern world. Consumers' busy lives are a major driver for the healthcare and OTC market as people opt for more convenient, multifunctional, and personalised products that better target their specific needs. The desire for more natural and less “fake” or “artificial” healthcare is another major driver in the market as consumers are sceptical of the health benefits of products they perceive to be “unnatural.” Additionally, the growth of the internet and smart technology is another key driver as consumers become more digitally connected to smartphones and tablets. This allows them to become more informed shoppers through company websites, blogs, and social media guiding their healthcare consumption.

Trend 1: Multifunctional Products

Consumers demand more convenient and functional healthcare products to save time. Busier lifestyles are driving demand for more functional healthcare and OTC products. Globally, consumers are suffering from perceived time constraints because of work, social lives and other responsibilities. Therefore, they seek products that save them precious time throughout the day. As a result, there is high demand for multifunctional products that can effectively meet several needs at once. Firms must innovate their products to capitalise on time-scarcity by offering products that are faster acting or target several symptoms at once.

Health-enhancing ingredients in food also appeal to consumers seeking greater functionality. Almost half (49%) of global consumers questioned in the most recent GlobalData survey believe that food is the most effective consumption format for health-enhancing ingredients. Manufacturers must use this positive perception of functional food by integrating ingredients that have proven benefits to treat or aid several health issues at once to attract consumers seeking more convenient solutions.

Functional products that improve general wellbeing and overall health are very attractive to consumers. Added health benefits in food and drink products appeal to modern consumers, especially for improving general wellbeing, appetite control and the immune system, because of how convenient and simple it is for consumers to maintain or improve their health through everyday products like food and drinks. Therefore, manufacturers should capitalise on this trend for multifunctional food and drink products by incorporating more nutritious and functional ingredients into their products, such as probiotics in low fat yoghurt to promote good digestive and gut health, to attract health conscious consumers seeking convenient, functional healthcare offerings.

Healthcare manufacturers should also expand their product portfolios and take inspiration from multifunctional food and drink products to better position themselves to meet the changing needs of consumers. For example, ingredients proven to target multiple needs, convenient spray or snack formats for new products, and products that can be consumed along with food or drinks will all be important ways for healthcare producers to utilise the multifunctional product trend and appeal to consumers.

One example is the UVO sun protective drink supplement. This unique multifunctional product claims to be a scientifically-proven health drink that provides up to 5 hours of sun protection. This makes it a convenient drink for busy, active consumers who want an easier method for applying sun screen. The product claims to also be suitable as a supplement to improve the skin after years of sun damage and provide essential vitamins, which will be very appealing to time-poor consumers.

The second is Kuxtal Alimentos Funcionales, a maca product which claims to be a multifunctional supplement that can be added to water, food and yoghurts to enhance the health benefits of everyday food and drink. It contains a number of essential vitamins, nutrients and minerals that claim to improve mental and physical health. It also positions itself as a superfood that increases overall strength and libido, and supports relaxation.

Trend 2: Tailor Made For Me

Consumers want products that put their health into their own hands. Globally, consumers seek out products that improve their health. This proactive attitude is part of an increasingly influential “just for me” or tailor made ethos in which consumers demand more bespoke health products that meet their personal needs, demographics and lifestyle. This trend is a reaction to the perceived low quality of mass produced health products that don’t effectively cater to consumers’ ages, gender, and lifestyle.

Technology and customisation is driving personalisation in the healthcare market. The rapid technological growth of recent years, specifically regarding DNA and blood sampling, has helped drive consumer demand for products that are tailored directly to their lifestyle, their DNA or even blood type. This is highlighted by the 44% of global consumers who find products customised to their own DNA appealing and a staggering 70% of consumers who believe customised healthcare products are also appealing. As a result, firms must better integrate new DNA and blood sampling into their production processes to target individuals more effectively. To capitalise on this trend, manufacturers must enable consumers to send in blood or DNA samples, either in store or through mail, and use websites to customise their healthcare products, by choosing which ingredients are used.

Age-specific healthcare products will convey personalisation to consumers. Different age groups have different health requirements; for instance children need more calcium for bone development while seniors need more protein to prevent muscle loss as they age. Manufacturers must better position their and OTC medicines and other products, especially vitamins, minerals and supplements, as age-specific. This will allow them to target the 56% of global consumers who would be more likely to purchase a product that is developed for their age group. For example, 25% of seniors are trying to consume as much omega oil as possible, compared to only 20% of 18-24 year olds, creating an opportunity to personalise omega oils for older consumers and grab their attention.

Targeting men and women with gender-specific healthcare products will appeal to individualistic consumers. Sports nutrition, supplements and functional beverages should be positioned more along gender lines to attract consumers seeking greater personalisation. Manufacturers should target the 74% of women who find healthcare products customised to meet their individual needs appealing. They could do this by offering products designed for women. Packaging should be colourful and feminine while product formulations should focus on using natural ingredients. Additionally, manufacturers can target the two thirds of male consumers who find customised products appealing by offering more male-centric products with darker coloured packaging.

One example here is Berocca Performance’s Fizzy Melt Chewable tablets. This on-the-go tablet is positioned towards active consumers who haven’t got the time to dissolve a normal Berocca tablet in water before consumption. The convenient packaging and lack of water will appeal to athletic consumers seeking more efficient healthcare products tailored to their active lifestyles.

A second example is Optrex Night Restore Gel Drops. This product claims to relax and repair eyes while the user is sleeping, which is unusual in the eye drops category. The product is well positioned to appeal to consumers who use screens throughout the day, causing eye strain. As a result, it is personalised to the needs of some modern office workers’ lifestyles and associated health problems.

Trend 3: Natural Lifestyles

Consumers demand simple, natural, and pure products that support their health. Globally, consumers have become more interested in natural products because they are increasingly viewed as healthier and better quality than “unnatural” ones which are considered “fake” in comparison. Accordingly, 54% of global consumers perceive natural to mean “real ingredients” which means firms must seek ways to integrate natural, familiar, ingredients into healthcare products if they wish to capitalise on this trend. Consumers have particularly high opinions of the positive health impacts of ingredients such as green tea (78%), almonds (77%), and honey (77%) which means manufacturers should focus on including these ingredients in product formulations, especially for OTC medication, supplements, and functional food and drinks.

Highly nutritious offerings appeal to consumers trying to cleanse their bodies of “toxins” to improve their health. Many consumers are choosing to live more natural lifestyles as a reaction to “toxins” – a catch-all phrase encompassing “pollutants”, “chemicals”, GMO and artificial ingredients – in staple and healthcare products because they perceive them to be negative for their health and wellbeing. As a result, consumers are opting for natural healthcare products that provide them with essential nutrients, such as antioxidants, vitamins and minerals, to “cleanse” their body of negative “toxins” and promote simple well being. In fact, 72% of global consumers believe that products with natural claims are more nutritious and therefore better for their health. Products with natural claims attract consumers trying to live a more holistic lifestyle because they are viewed as safe, nutritious, and healthy.

This “back to basics” approach consumers are taking with their health offers manufacturers an opportunity to reformulate products with natural ingredients to attract holistic consumers in the long term. Manufacturers should ensure that supplements and functional food and drink products are naturally high in nutrients to appeal to the 90% of global consumers that find those products to be somewhat or very appealing. Firms should also distance their products from negatively perceived ingredients and “toxins”, such as artificial ingredients, “pollutants” and “chemicals”, to further appeal to holistic consumers. This should also be supported with simple and minimalist packaging which conveys the idea of nature.

Natural food and drink claims appeal to the majority of global consumers. Consumers are sceptical of products, especially healthcare ones, without natural claims because they associate artificial ingredients with being unhealthy. The perception that natural products are better than non-natural alternatives is further highlighted by the majority of global consumers who believe that food and drink products provide the same or better health benefits than non-prescription medications. This means that functional food and drink producers have the ability to emphasise health benefits to attract consumers that believe that real food and drink products are healthier than pills.

The Thylbert Rooibos Kombucha drink, a fermented Chinese tea, is made from rooibos to create a functional health drink. It claims to promote good digestive and gut health, support the immune system and help consumers detox. As such, the product is positioned as a “clean” and functional drink which appeals to people living holistic lifestyles.

Similarly, Gargle Away by Nature's Jeannie is positioned as an all-natural way to soothe sore throats. It is made with Himalayan salt, apple cider vinegar, Mediterranean oregano, licorice root, cayenne pepper, organic honey and lemon. The “back to basics” approach of the product, using only natural ingredients, will appeal to consumers seeking more pure products free from artificial ingredients and “toxins”.

Trend 4: Smart Healthcare

The internet and smart tech are enabling consumers to research, purchase, and use products differently. Consumers are increasingly self-diagnosing through the internet, new smart products and apps. The proliferation of the internet, tablets and smartphones in recent years is radically changing how consumers use healthcare products. Technology and the internet allow consumers to conveniently their own diagnose health problems. For instance, consumers are increasingly taking a DIY approach to their health, with 19% of global consumers first checking the internet for medical and health advice rather than a medical professional. However, the use of digital tools for monitoring or managing health is still in its infancy with 43% of global consumers still going to medical professionals/doctors first for medical advice. Consumers are expected to increasingly rely on the internet for medical advice because of the plethora of information available, simplicity, convenience and reliability of key websites.

Consumers are also using smart products to improve their health and lifestyles. Smart healthcare tools are becoming essential to help consumers maintain a healthy lifestyle. Fitness trackers, exercise apps and step counters help consumers monitor important data, such as heart rate, movement, calories burned and distanced travelled, so that they can better maintain or improve their personal wellbeing. For example, 26% of global consumers currently use digital tools to monitor or manage their exercise and fitness while a further 41% of consumers would consider using smart tools in the future. This presents manufacturers with a variety of new, exciting opportunities to enhance their products using smart technology. For instance, brands should create user friendly apps and websites alongside their products to encourage exercise, recommend pill usage, and plan diets which will appeal to tech-savvy consumers.

In addition, manufacturers should diversify what they monitor with smart healthcare to differentiate themselves from competitors. For example, though firms should ensure they effectively monitor calories and exercise; they should also offer ways to track sleep quantity and quality, oral hygiene, and skin conditions. Focusing on these health issues will appeal to consumers seeking to improve their overall health and wellbeing through smart healthcare tools.

The Spray Health Echo Band is currently still in beta testing but it offers consumers with chronic illnesses, such as arthritis, the ability to monitor their own conditions over long periods of time. The band uses optical sensors to measure and analyze blood composition and flow, and tracks blood pressure, heart rate, respiratory rate, and a full blood gas panel. This information is stored in the cloud and can be used to provide more in-depth and accurate, healthcare solutions to individuals.

Meanwhile the Kenzen ECHO Smart Patch is a wearable device that analyses sweat, along with other key data, and sends it to a smartphone app that allows users to check on previous, and predicted, health information. The product is meant to be placed directly on the torso, under clothes, and worn 24 hours a day for constant health monitoring of physical activity, blood levels and more.