In the enlarged firm, which is expected to become a paper and packaging major worth over £10bn in market value, shareholders of Mondi will own 54% while DS Smith shareholders will hold the remaining 46% stake

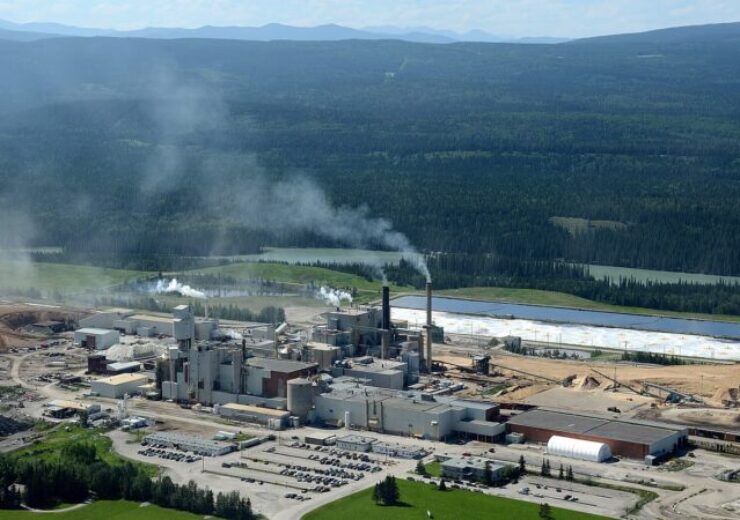

Mondi’s Hinton Pulp mill in Alberta, Canada. (Credit: Mondi)

UK-based packaging and paper firm Mondi has agreed in principle to an all-share deal to acquire smaller British rival DS Smith for £5.14bn.

The merger is anticipated to establish a paper and packaging major worth over £10bn in market value.

Both companies have agreed on the important financial terms of a possible all-stock offer by Mondi to DS Smith. According to the terms of the agreement, Mondi will acquire the entire issued and to be issued share capital of the latter.

The shareholders of Mondi will own 54% and DS Smith shareholders will hold the remaining 46% stake in the enlarged firm.

The deal represents an implied value of £3.73 for each DS Smith share, which is a premium of 33%, based on the closing share price of £2.8 per share on 7 February 2024, which is the day prior to the commencement of the offer period.

As per the terms of the deal, three of DS Smith’s non-executive directors will join the board of the enlarged Mondi group.

In a joint statement, the firms said: “The combination is an exciting opportunity to create a pan-European industry leader in paper-based sustainable packaging solutions.”

The potential combination between the firms, which was announced last month, is anticipated to establish one of the top European providers of paper-based sustainable packaging solutions.

Both packaging firms are expected to have enhanced exposure to structural growth trends in sustainable packaging.

The combination of both Mondi’s and DS Smith’s expertise in the corrugated value chain will bring together cost-efficient virgin containerboard mills and strategically located and integrated recycled containerboard production.

Additionally, the enlarged entity will serve global fast-moving consumer goods (FMCG) customers using the innovation capabilities of both Mondi and DS Smith.

The combination is also anticipated to create a strong balance sheet, strong cash flow profile, and strategic flexibility for continued growth investment, said the firms.