US technology firm Eastman Kodak has said that it expects to receive up to $390m by selling its flexographic packaging division to Montagu Private Equity.

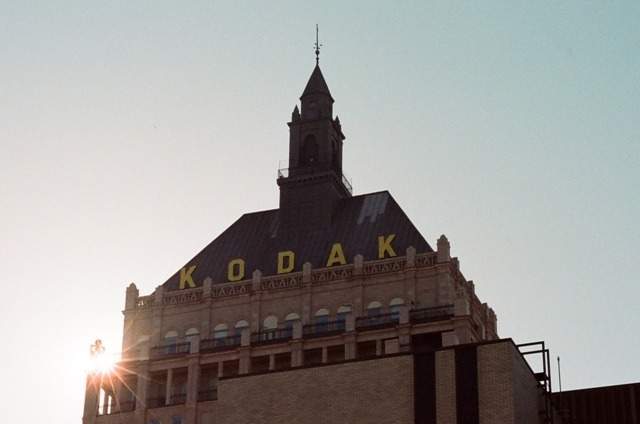

Image: Kodak tower. Photo: courtesy of Eastman Kodak Company.

Kodak’s flexographic packaging division is engaged in the development, manufacturing and marketing of flexographic products to the packaging print segment.

The deal includes base purchase price of $340m, potential earn-out payments of up to $35m over the period through 2020 based on achievement of agreed-upon performance metrics and $15m payable by Montagu to Kodak at the closing as a prepayment for various services.

Kodak intends to use the net proceeds from the deal to decrease outstanding term debt.

Montagu director Ed Shuckburgh said: “We focus on the acquisition of companies producing products or services that would be badly missed if the business did not otherwise exist, and are delighted to be investing in Kodak’s Flexo business, which has been very well established within Kodak and clearly meets our target profile.”

Kodak’s Flexo business provides imaging technologies for the graphics customization of printed packaging materials, and produces flexographic plate imaging system, called Kodak Flexcel NX, which helps in delivering better image resolution quality.

Flexography is a form of packaging printing, which is used to apply images on any substrate, including flexible packaging.

Subject to the receipt of required regulatory approvals and satisfaction of closing conditions, the deal is expected to complete in the first half of 2019.

Once the deal concludes, the flexographic packaging division will run as a new standalone firm with the same organizational structure, and management team.

Chris Payne, who is the president of the flexographic packaging division, will serve as CEO for the new company.

After the completion of the deal, Kodak will continue to concentrate on the areas of Sonora environmental plates, enterprise inkjet, workflow software and brand licensing.

Kodak CEO Jeff Clarke said: “This transaction is an important turning point in our transformation and is a significant, positive development for Kodak.

“The sale of the Flexographic Packaging Division unlocks value for shareholders and strengthens our financial position by providing a meaningful infusion of cash which allows us to reduce debt, improving the capital structure of the Company and enabling greater flexibility to invest in our growth engines.”